The Top 5 Operating, Fundraising, and Investing Resources

Female Founders Mentorship Network Newsletter #2

Welcome to the 2nd issue of the quarterly female founders mentorship network newsletter. As a refresher, I started this network to create a centralized database for female founders to connect with allies and for allies to connect with each other. These newsletters cut through the noise and fill the white space in existing content for female founders, investors, and operators.

Operating: the top 5 functional resources

SEO strategies: “We recently analyzed 11.8 million Google search results to answer the question: Which factors correlate with first page search engine rankings?”

My favorite tips: a) the #1 search result has 3.8x more backlinks than results #2-#10, b) keyword and title tags do NOT correlate with rankings, 3) the average first page search result has 1,447 words

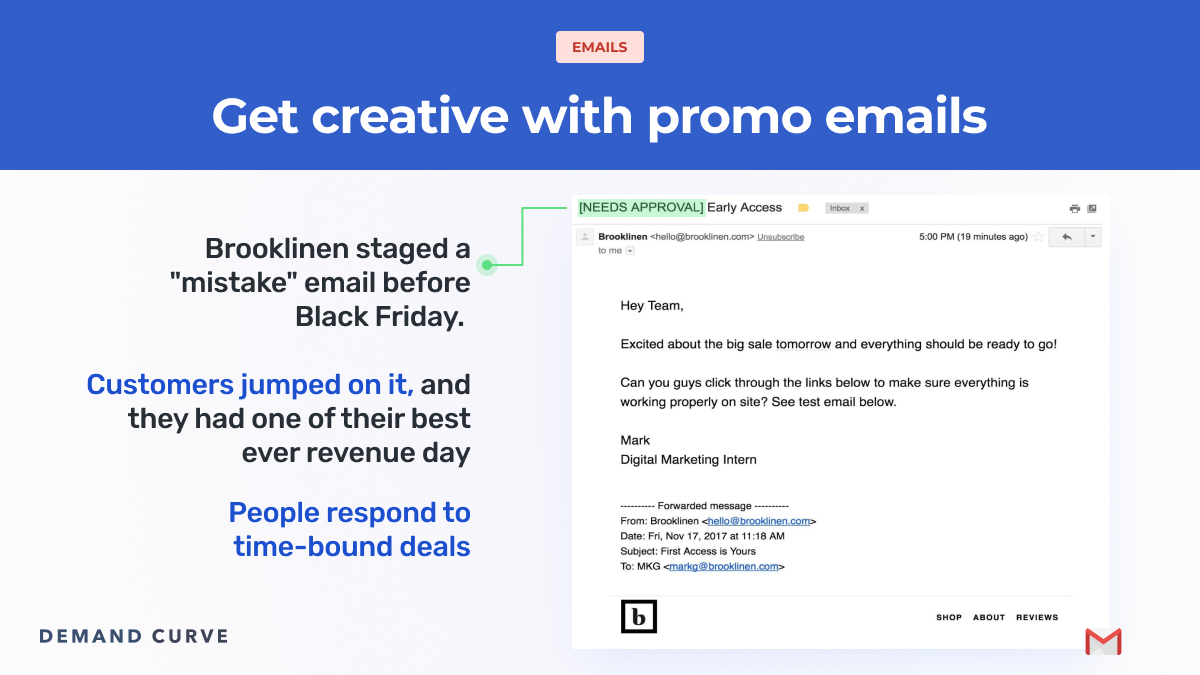

Promo strategies: Demand Curve shared Brooklinen’s staged email leak (screenshot below), which is one of the most brilliant promo emails!

Leadership strategies: one of my favorite interviews with Okta chief of staff, Angela Grady

Highlighted tips: 1) do not be afraid of hiring people more capable than you, 2) boundaries make you better, 3) be more of a peer and less of a mentor

Brand strategies: another favorite interview with Dr. Linda Ellison, founder of kaü Health

Most notable tip: instead of working with a very expensive brand agency, integrate the different pieces yourself through hiring contract designers, photographers, etc.

Design strategies: very excited about an interview coming soon with Anamita Guha, global lead of product management at IBM

My favorite tip: engage in visual mind mapping exercises to hone your ability to draw non-intuitive connections. Place a topic of interest at the center of a drawing board and then connect it with related words and these words with each other. Play iAssociate games. Play the Wikipedia Game where you click on one page and see which others it leads you to.

Fundraising: the top 5 fundraising tips

Start by stating clearly and simply what you are doing. Too often, founders start by setting the stage and describing their perspective on macro trends, which can create more confusion and disagreement with investors (who often have strongly held views about macro trends) before you even get to what you are building.

Go through other founders for investor intros. Investors are much more likely to take intros from their own founders than other investors. Chances are you have founder friends who have raised some type of round. Ask them if they are willing to connect you with their cap table. Then, make the intro request process as easy for them as possible by sending over customized messages they can forward to each investor.

In the early stage, focus on the big idea. Too often, founders, especially female and diverse founders, do not feel confident when pitching to a room full of white men. So they feel like they need to arm themselves with data and all the nitty gritty details around actually building their business from the warehouse to the financial projections to the supply chain and more. Of course, this is crucial to know and plan when running the business, but investors are more excited about the long term, big picture vision. They are in the business of investing in dreams and a better future. Focus more on the “so what” rather than the “what.”

Answer the “why now.” Investors take timing very seriously. The right idea at the wrong time leads to a bad investment. Include a slide articulating why the macro factors from culture to technology to regulation make the current timing perfect.

Send thoughtful check in emails. Instead of following up with generic messages like “just circling back,” write a concise but impactful email highlighting your growth, meaningful pivots, and exciting road ahead.

Investing: the top 5 reads

Shawn Xu shares 10 key learnings from his time at Floodgate

My favorite tip: generate your own serendipity by leaning into platform programs

Amanda Robson at Cowboy shares her biggest takeaways on seed investing

My favorite advice: find founders who are talent magnets

(a shameless plug) I left my job in VC a month ago and shared what I did not expect to learn; my personal favorite tip: see your career journey as a process of finding product market fit

Jesse Livermore (Twitter pseudonym) on Invest Like the Best

One of the best fundamental deep dives on the macro factors I have seen!

8 angel investors on how they got started, what they look for, and what they wish they had known

My favorite reads/listens:

Kristina Hu’s newsletter on career advice for students and new grads

Ada Yang’s China Consumer newsletter on the fascinating trends in China

Jenny Wang’s Techsetters podcast on changemakers in tech

Unusual Ventures Field Guide for founders

EnrichHER: an excellent source of non-VC funding for founders

Women in VC’s women led fund report

The INSANE story of the 1904 Olympics from The Constant

Mozilla Builders Fix the Internet showcase

A host of fascinating, mission driven companies from Swiffer for personal data to Honey for carbon offsets